Industry Perspectives Op-Ed: Trudeau government doubles down on missing the mark

Industry Perspectives Op-Ed: Trudeau government doubles down on missing the mark

Earlier this year, public opinion research company Leger published the results of a nationwide poll. One result stood out. Seventy per cent of Canadians agreed with the statement: “It feels like everything is broken in this country right now.” To young...

Associations , Government

CAPP shares mixed reaction to federal budget

CALGARY – The Canadian Association of Petroleum Producers (CAPP) is hopeful abou...

Associations , Government

Legal Notes: Too much information can be costly

Striking a balance between providing too little or too much documentation in sup...

Government

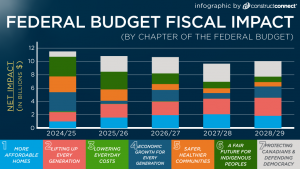

2024 Federal Budget: Construction Coverage Hub

Canadian Finance Minister Chrystia Freeland unveiled the federal budget in the H...

Economic , Government

Certificates

Published Certificates and Notices

Tenders

Tenders for Construction Services

Latest News

Industry Perspectives Op-Ed: Trudeau government doubles down on missing the mark

Earlier this year, public opinion research company Leger published the results o...

Associations , Government

Chandos names Sean Penn as new CEO

CALGARY – Chandos Construction has named Sean Penn as its new chief executive of...

Economic

CAPP shares mixed reaction to federal budget

CALGARY – The Canadian Association of Petroleum Producers (CAPP) is hopeful abou...

Associations , Government

Legal Notes: Too much information can be costly

Striking a balance between providing too little or too much documentation in sup...

Government

Liberals must now sell a budget they say will help younger Canadians catch up

OTTAWA — It's now up to the federal Liberal government to sell a spending plan i...

Economic , Government

TC Energy pipeline rupture sparks wildfire near Edson, Alta.

A natural gas pipeline owned by TC Energy Corp. ruptured near Edson, Alta., on T...

OH&S , Resource

National construction cost report forecasts slow 2024 growth

TORONTO — A new report forecasts cautious optimism for the Canadian construction...

Economic

B.C. to add 240 complex-care housing units in communities throughout the province

KELOWNA, B.C. — British Columbia is planning to add 240 new units to its complex...

Projects

The Vancouver housing crisis and two different ways of addressing it

According to an April 2024 Royal Bank of Canada (RBC) report on housing affordab...

Economic

Quebec housing market crawling out of stagnation

Quebec’s three major housing markets, Montreal, Quebec City and Gatineau, see si...

Economic

Inside Innovation: Rebranding Portland cement reflects industry shift from carbons

Portland cement has been synonymous with construction for nearly two centuries....

Technology , US News

2024 Federal Budget: Construction Coverage Hub

Canadian Finance Minister Chrystia Freeland unveiled the federal budget in the H...

Economic , Government

Government documents confirm coal lobbying on Rockies mining, show months of planning

EDMONTON - Documents released under Alberta Freedom of Information laws confirm...

Government , Resource

Budget 2024 streamlining current resource initiatives, increasing Indigenous participation

The latest federal budget is light on new projects with a focus on greater effic...

Government , Resource

Budget 2024: Key numbers from the Liberals’ latest spending plan

OTTAWA — Here are some key numbers from the Liberal government's federal budget:...

Economic , Government

New housing spending dominates Budget 2024

Federal Finance Minister Chrystia Freeland reiterated her government’s recent he...

Economic , Government , Projects

Labour force a key element of federal budget to bolster housing supply

The 2024 federal budget underlines the need to build more housing and provides m...

Government , Labour

Federal budget introduces, elaborates on clean technology tax credit plans

The 2024 federal budget is re-emphasizing the government’s commitment to a globa...

Government , Resource

B.C. construction sector seeks support as worker shortage, late payments persist: BCCA

VICTORIA - British Columbia's construction industry says its workforce numbers h...

Associations , Economic , Labour

Financing, Foreign Trade, and Demographic Factors Bode Well for Alberta

While recently released data on the Alberta economy still paints a mixed picture...

Economic

Construction Conversations: Eby voices commitment to industry in wide-ranging VRCA discussion

As British Columbia heads closer to an election this October, its premier is rea...

Associations , Government

Residential construction workforce needs to double: BuildForce

A new report from BuildForce Canada lays out in stark relief the dimensions of t...

Economic , Labour

Freeland to present federal budget today after teasing much of it in recent weeks

OTTAWA - Finance Minister Chrystia Freeland is finally set to present the federa...

Government

Saskatchewan construction investment on the rise

REGINA – Building permits in Saskatchewan showed substantial growth over the las...

Economic

Metro Vancouver construction market activity hits new record

VANCOUVER – The Vancouver home construction market set a new record last year, a...

Economic

Global Market Scan: The evolving landscape of solar power

Throughout its history, solar power has experienced many phases of growth. Despi...

Economic , Resource

Climate risks in Canada a multibillion-dollar problem, but it doesn’t have to be: Panel

In 2023 catastrophic insured losses in Canada were $3.4 billion. Uninsured losse...

Associations , Resource

Provincial-municipal imbalance has to change to manage housing crisis: AMO

Representing the province’s 444 municipalities, the Association of Municipalitie...

Associations , Government

Feds conduct environmental assessment for Manitoba flood control project

OTTAWA – The federal government is conducting an environmental assessment of the...

Government , Infrastructure

Heidelberg Materials announces Edmonton CCUS milestone

EDMONTON – Heidelberg Materials North America recently announced it has awarded...

Projects , Resource

Alberta market heading for a record 2024 in housing construction

BILD Alberta, which represents Alberta developers and residential builders, expe...

Economic , Projects

Middlesboro Bridge in Merritt, B.C. undergoes $14M overhaul after flood damage

Construction crews have completed demolition work at the flood-damaged Middlesbo...

Infrastructure

Most Read News

B.C. ups investment in forestry sector with $70.3M in funding

VANCOUVER – The Province of British Columbia has announced a capital investment...

Government , Resource

Done: Expanded Trans Mountain pipeline launches May 1

Four-and-a-half years after construction began, one of Canada’s most controversi...

Infrastructure , Projects , Resource

Manitoba introduces carbon capture and storage legislation

WINNIPEG – The Government of Manitoba is introducing legislation to reduce green...

Government , Resource

Two killed, one injured after shooting at Edmonton construction site

EDMONTON - Edmonton police are investigating the deaths of two men in the southw...

OH&S

Federal budget introduces, elaborates on clean technology tax credit plans

The 2024 federal budget is re-emphasizing the government’s commitment to a globa...

Government , Resource

M5 at Main Alley: A 25-storey mass timber tower prototype

M5, a 25-storey, mass timber rental housing tower, one of the tallest in the wor...

Projects , Resource

Queen’s Park to permit 18-storey mass timber construction

TORONTO — The Ontario government has announced it intends to amend the Building...

Government

Preferred proponent announced for Surrey Langley Skytrain station construction

SURREY, B.C. – South Fraser Station Partners has been chosen by the Government o...

Government , Infrastructure , Projects

From ConstructConnect

Latest Infographics

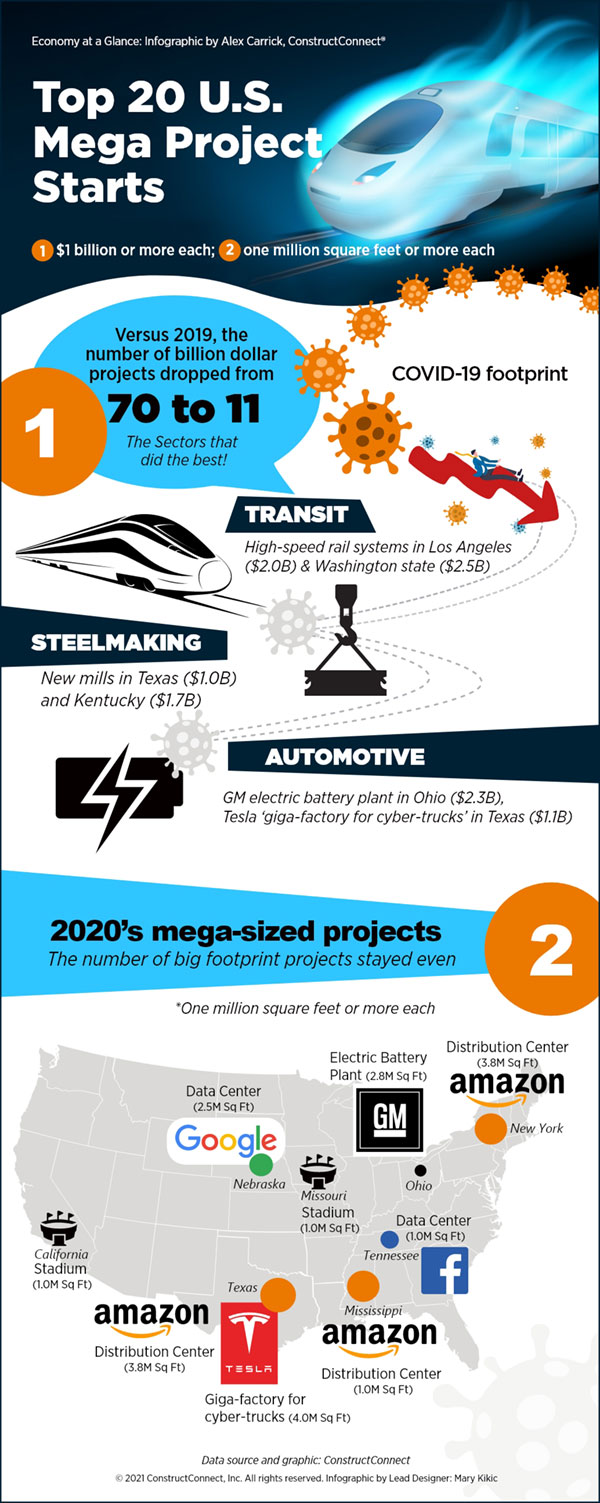

Top 20 U.S. Mega Project Starts

In 2020, there were 11 projects valued at $1 billion or more each, and 26 projec...

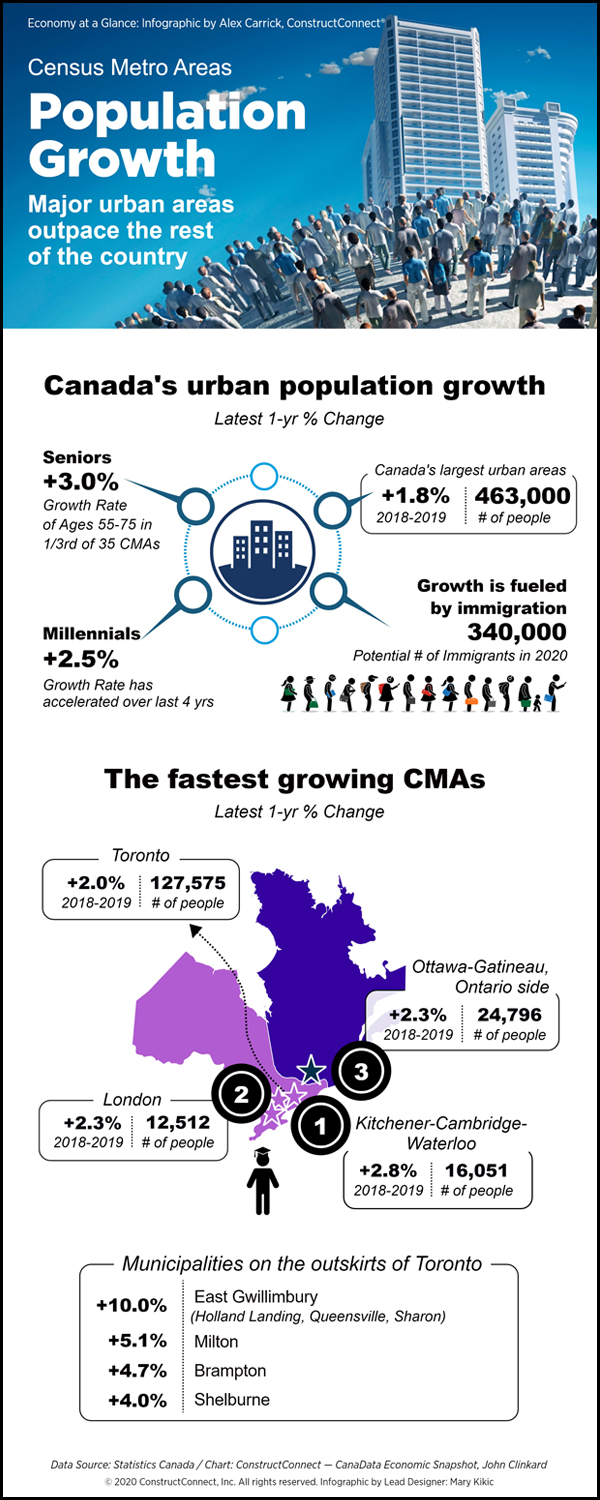

Canada's Urban Population Growth

This infographic looks at the surge in Canada's urban population growth.

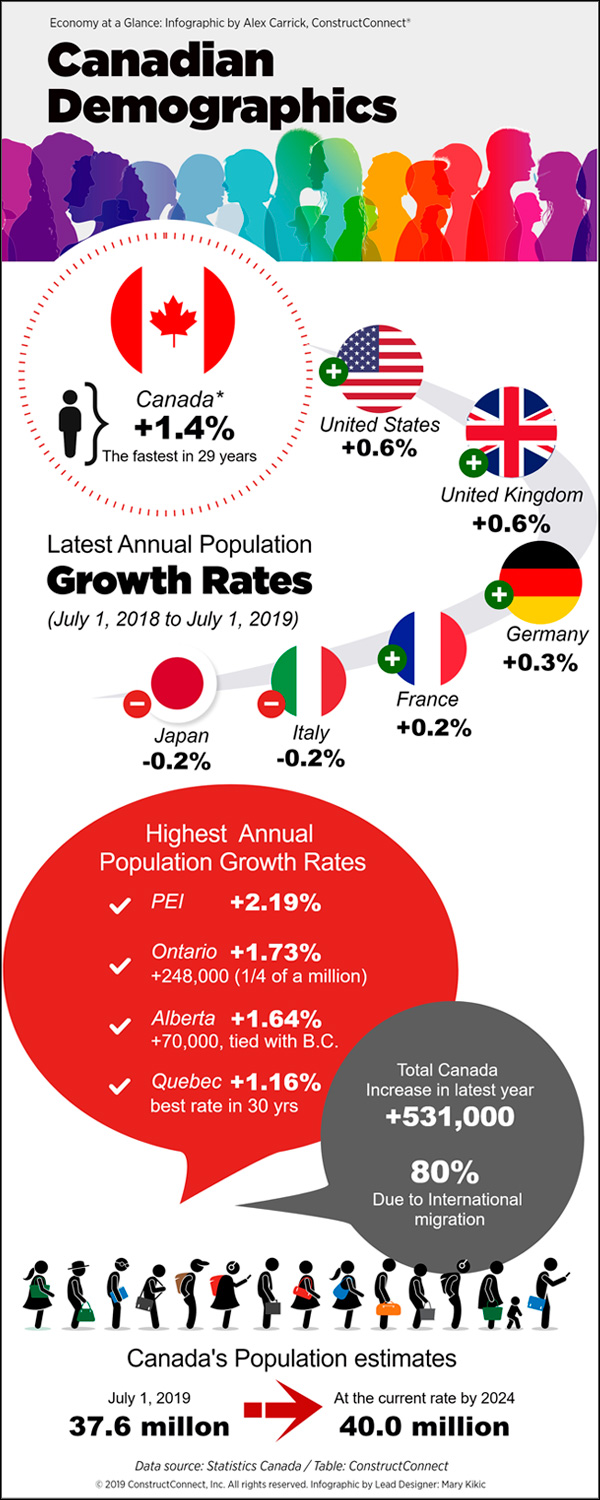

Canadian Demographics

This infographic looks at the latest Canadian population growth rates.