BuildForce Canada report looks at impact of retrofitting buildings to achieve net-zero goals

BuildForce Canada report looks at impact of retrofitting buildings to achieve net-zero goals

OTTAWA — A new report prepared by BuildForce Canada considers the impact of retrofitting existing buildings to improve their energy efficiency in support of the Government of Canada’s goals to achieve net-zero by 2050. Building a Greener Future: Estimati...

Economic , Resource

B.C. selects next communities for housing targets

VICTORIA – The Government of British Columbia has identified a new set of priori...

Government , Projects

Indigenous project financing plan praised as game-changer

First Nations major project proponents are hailing the establishment of a $5-bil...

Projects

B.C. to increase local milk production with $25-million factory investment

ABBOTSFORD, B.C. — The British Columbia government is spending up to $25 million...

Government , Projects

Certificates

Published Certificates and Notices

Tenders

Tenders for Construction Services

Latest News

Top 10 largest construction project starts in Canada – March 2024

The accompanying table records the 10 largest construction project start...

Economic , Projects

BuildForce Canada report looks at impact of retrofitting buildings to achieve net-zero goals

OTTAWA — A new report prepared by BuildForce Canada considers the impact of retr...

Economic , Resource

Calgary Construction Association reaffirms support for city’s housing strategy

CALGARY – The Calgary Construction Association (CCA) has announced it continues...

Associations , Government

B.C. selects next communities for housing targets

VICTORIA – The Government of British Columbia has identified a new set of priori...

Government , Projects

B.C. to increase local milk production with $25-million factory investment

ABBOTSFORD, B.C. — The British Columbia government is spending up to $25 million...

Government , Projects

Legal Notes: The liability potential for legal counsel with frivolous liens

The liability consequences can spread beyond the party launching a lien, if it i...

Government

Indigenous project financing plan praised as game-changer

First Nations major project proponents are hailing the establishment of a $5-bil...

Projects

B.C. to improve flood preparation in Township of Langley

LANGLEY, B.C. – The Government of British Columbia is working to improve pump ca...

Infrastructure

B.C.’s future energy needs require electricity and gas: VICA panellists

British Columbia will need more energy in the future and getting there will requ...

Associations , Resource

WorkSafeBC announces 2024 approach to inspections

RICHMOND, B.C. – WorkSafeBC is indicating an emphasis on inspections in 2024 as...

OH&S

Increased wildfire threats raise public awareness of forestry industry: expert

A public opinion expert sees both opportunity and new challenges as British Colu...

Resource

Olympic Stadium gains respectability through roof recycling competition

Montréal’s 1976 Olympic Stadium roof has had a troubled life from its conception...

Projects , Resource

Federal housing money too little too late for some stakeholders

The federal government’s $4 billion national Housing Accelerator Fund (HAF) is “...

Associations , Government

Land and development issues mire affordable Vancouver housing

Vancouver’s affordable housing deficit is mired in development issues, land shor...

Economic , Government

Fire destroys Second World War hangar at former Edmonton airport

An aircraft hangar built during the Second World War at Edmonton's former munici...

Infrastructure , OH&S

Top 10 major upcoming High-Rise Residential and Transportation construction projects – Canada – April 2024

The accompanying tables show the top 10 largest upcoming High-Rise Residential a...

Economic , Projects

Heritage Winnipeg Preservation Award winners announced

WINNIPEG – The winners of Heritage Winnipeg’s 38th annual Preservation Awards ha...

Projects

Phipps-McKinnon building in Edmonton to become partial residential conversion

EDMONTON – Edmonton’s Phipps-McKinnon building is set to become a partial office...

Projects

B.C. funds rural Kootenay economic development

RADIUM HOT SPRINGS, B.C. – The Government of British Columbia is funding local g...

Government

Rental market spurring Montreal housing construction

The Montreal housing market has seen a sharp increase in rental construction ver...

Economic

Top 10 major upcoming Residential and Transportation Terminal construction projects – U.S. – April 2024

The accompanying tables show the top 10 largest upcoming Residential and Transpo...

Projects

News Tracker: North America’s Housing Crisis

It’s no secret North America is in the throes of a housing crisis with governmen...

Economic , Government , Labour , Projects , US News

New women’s transition and child care housing complex opens in Kitimat

KITIMAT, B.C. – A new development opening in Kitimat, B.C. will provide 44 homes...

Projects

Manitoba invests $3.8 million in Dauphin main street reconstruction

DAUPHIN, MAN. – The Government of Manitoba is putting $3.8 million towards recon...

Infrastructure

Saskatchewan urban housing starts rise 12.1 per cent

REGINA – Saskatchewan’s urban housing starts rose 12.1 per cent in March 2024 co...

Economic

B.C. putting $72 million towards community climate action

VICTORIA – The Government of British Columbia’s 2024 budget is putting funding t...

Government

B.C.’s Colquitz River bridges undergoing $35.5M retrofits

Extensive construction work will be starting this summer on a $35.5-million proj...

Infrastructure

Climate and housing both part of the same solution: Iveson

Edmonton’s former mayor is optimistic the housing and climate crises can be addr...

Projects , Resource

RAIC National Urban Design Award winners highlight climate change, equity, justice

OTTAWA — The recipients of the 2024 National Urban Design Awards by the Royal Ar...

Associations

All that glitters may not be gold when it comes to homebuilding innovation

They say you can have two of three things: speed, quality, affordability. But wh...

Associations , Technology

Fourplexes: A tale of two neighbouring communities

The City of Windsor this year stirred controversy by rejecting as much as $40 mi...

Economic , Projects

Budget 2024 is ‘a lot of prose and very little substance,’ says MHCA president

While the budget committed billions to new housing initiatives and to streamlini...

Associations , Government

Most Read News

B.C. ups investment in forestry sector with $70.3M in funding

VANCOUVER – The Province of British Columbia has announced a capital investment...

Government , Resource

Done: Expanded Trans Mountain pipeline launches May 1

Four-and-a-half years after construction began, one of Canada’s most controversi...

Infrastructure , Projects , Resource

Winnipeg promotes infill development to reduce affordable housing shortage

In his recent State of the City address, Winnipeg Mayor Scott Gillingham says lo...

Economic

Saskatchewan water agency invests in key infrastructure projects

REGINA – Saskatchewan’s Water Security Agency (WSA) is working on more than 60 w...

Government , Infrastructure

Federal budget introduces, elaborates on clean technology tax credit plans

The 2024 federal budget is re-emphasizing the government’s commitment to a globa...

Government , Resource

New housing spending dominates Budget 2024

Federal Finance Minister Chrystia Freeland reiterated her government’s recent he...

Economic , Government , Projects

Top 10 major upcoming Residential and Transportation Terminal construction projects – U.S. – April 2024

The accompanying tables show the top 10 largest upcoming Residential and Transpo...

Projects

Preferred proponent announced for Surrey Langley Skytrain station construction

SURREY, B.C. – South Fraser Station Partners has been chosen by the Government o...

Government , Infrastructure , Projects

From ConstructConnect

Latest Infographics

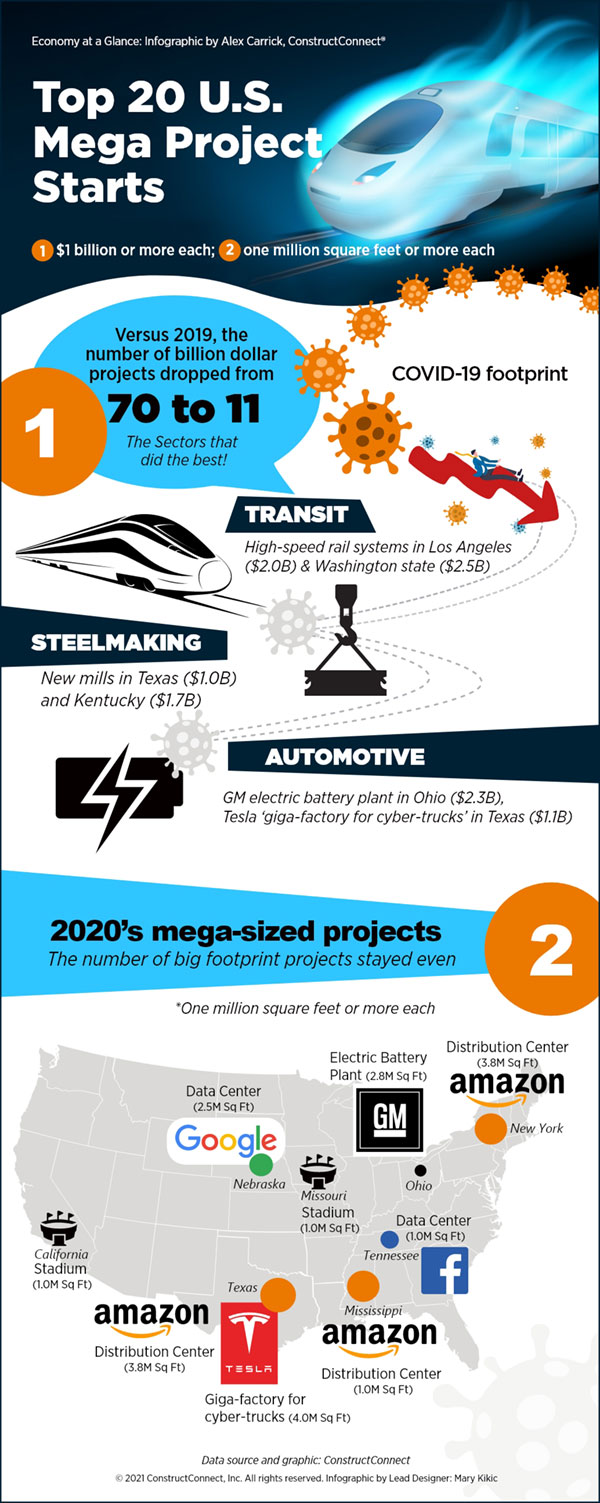

Top 20 U.S. Mega Project Starts

In 2020, there were 11 projects valued at $1 billion or more each, and 26 projec...

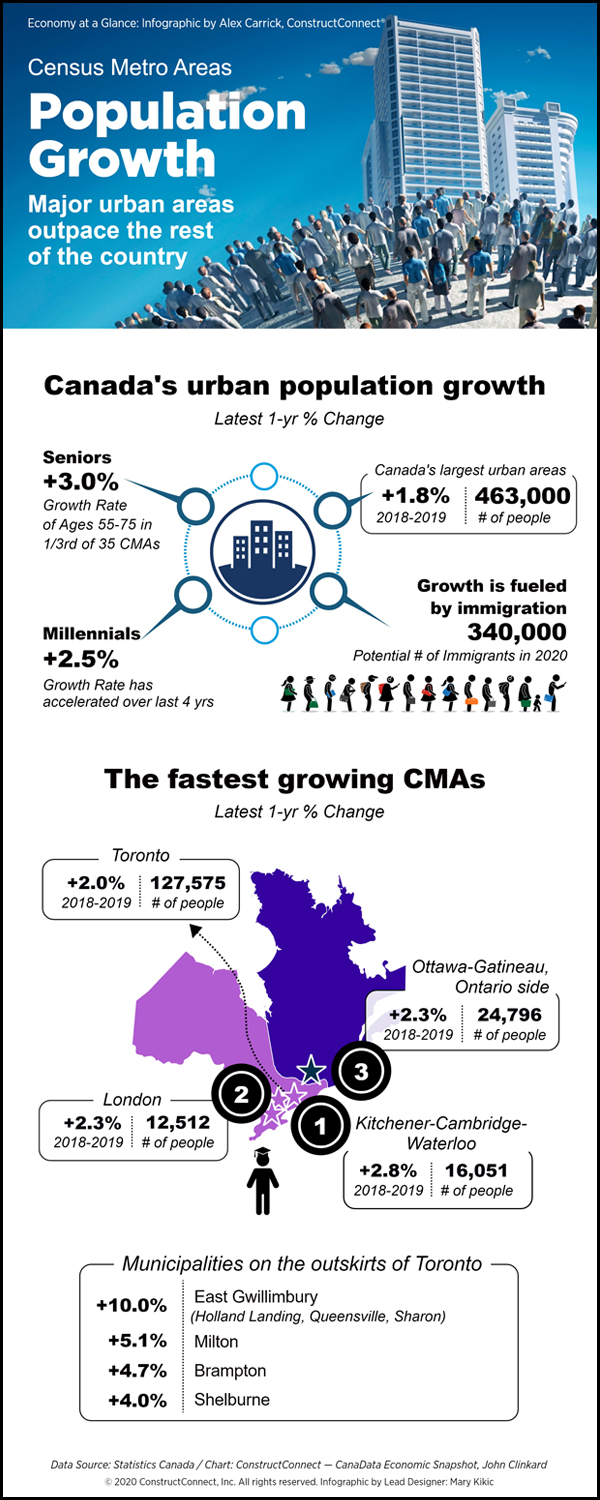

Canada's Urban Population Growth

This infographic looks at the surge in Canada's urban population growth.

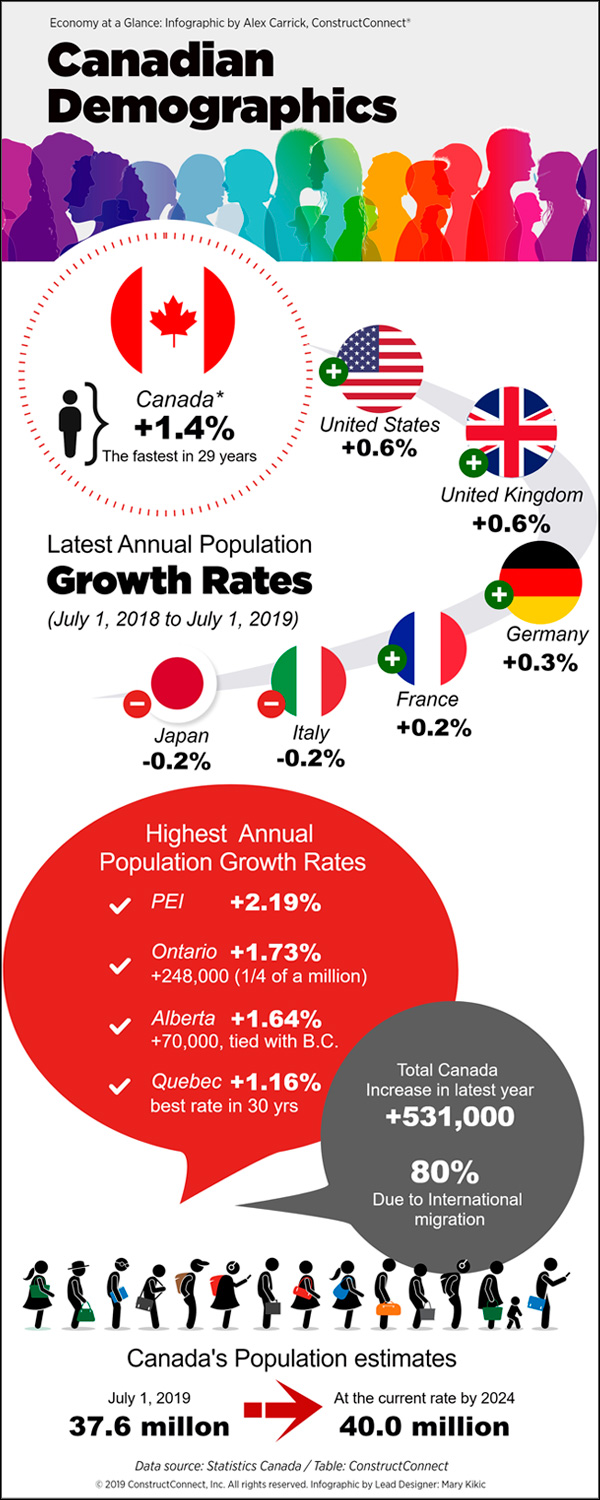

Canadian Demographics

This infographic looks at the latest Canadian population growth rates.