Heritage Winnipeg Preservation Award winners announced

Heritage Winnipeg Preservation Award winners announced

WINNIPEG – The winners of Heritage Winnipeg’s 38th annual Preservation Awards have been announced. They were named at a free public event on April 17 at the historic Millennium Centre in Winnipeg’s Exchange District. “It was so wonderful to recognize an...

Projects

B.C. funds rural Kootenay economic development

RADIUM HOT SPRINGS, B.C. – The Government of British Columbia is funding local g...

Government

Phipps-McKinnon building in Edmonton to become partial residential conversion

EDMONTON – Edmonton’s Phipps-McKinnon building is set to become a partial office...

Projects

B.C.’s Colquitz River bridges undergoing $35.5M retrofits

Extensive construction work will be starting this summer on a $35.5-million proj...

Infrastructure

Certificates

Published Certificates and Notices

Tenders

Tenders for Construction Services

Latest News

Land and development issues mire affordable Vancouver housing

Vancouver’s affordable housing deficit is mired in development issues, land shor...

Economic , Government

Fire destroys Second World War hangar at former Edmonton airport

An aircraft hangar built during the Second World War at Edmonton's former munici...

Infrastructure , OH&S

Top 10 major upcoming High-Rise Residential and Transportation construction projects – Canada – April 2024

The accompanying tables show the top 10 largest upcoming High-Rise Residential a...

Economic , Projects

Heritage Winnipeg Preservation Award winners announced

WINNIPEG – The winners of Heritage Winnipeg’s 38th annual Preservation Awards ha...

Projects

Phipps-McKinnon building in Edmonton to become partial residential conversion

EDMONTON – Edmonton’s Phipps-McKinnon building is set to become a partial office...

Projects

B.C. funds rural Kootenay economic development

RADIUM HOT SPRINGS, B.C. – The Government of British Columbia is funding local g...

Government

Rental market spurring Montreal housing construction

The Montreal housing market has seen a sharp increase in rental construction ver...

Economic

Top 10 major upcoming Residential and Transportation Terminal construction projects – U.S. – April 2024

The accompanying tables show the top 10 largest upcoming Residential and Transpo...

Projects

News Tracker: North America’s Housing Crisis

It’s no secret North America is in the throes of a housing crisis with governmen...

Economic , Government , Labour , Projects , US News

New women’s transition and child care housing complex opens in Kitimat

KITIMAT, B.C. – A new development opening in Kitimat, B.C. will provide 44 homes...

Projects

Manitoba invests $3.8 million in Dauphin main street reconstruction

DAUPHIN, MAN. – The Government of Manitoba is putting $3.8 million towards recon...

Infrastructure

Saskatchewan urban housing starts rise 12.1 per cent

REGINA – Saskatchewan’s urban housing starts rose 12.1 per cent in March 2024 co...

Economic

B.C. putting $72 million towards community climate action

VICTORIA – The Government of British Columbia’s 2024 budget is putting funding t...

Government

B.C.’s Colquitz River bridges undergoing $35.5M retrofits

Extensive construction work will be starting this summer on a $35.5-million proj...

Infrastructure

Climate and housing both part of the same solution: Iveson

Edmonton’s former mayor is optimistic the housing and climate crises can be addr...

Projects , Resource

RAIC National Urban Design Award winners highlight climate change, equity, justice

OTTAWA — The recipients of the 2024 National Urban Design Awards by the Royal Ar...

Associations

All that glitters may not be gold when it comes to homebuilding innovation

They say you can have two of three things: speed, quality, affordability. But wh...

Associations , Technology

Fourplexes: A tale of two neighbouring communities

The City of Windsor this year stirred controversy by rejecting as much as $40 mi...

Economic , Projects

Budget 2024 is ‘a lot of prose and very little substance,’ says MHCA president

While the budget committed billions to new housing initiatives and to streamlini...

Associations , Government

Winnipeg promotes infill development to reduce affordable housing shortage

In his recent State of the City address, Winnipeg Mayor Scott Gillingham says lo...

Economic

Your top JOC headlines: April 15 to 19

Your top JOC headlines this week feature coverage of the 2024 federal budget in...

Economic , Government , Infrastructure , Resource

National tour offers overview of major new CCDC documents

The Canadian Construction Documents Committee (CCDC) has announced a nationwide...

Projects

Stakeholders praise housing focus but cite budget gaps

Construction stakeholders found lots to like in the Justin Trudeau government’s...

Associations , Government

The Construction Record Podcast – Episode 343: Interviews from COFI 2024

On this episode of The Construction Record Podcast™, digital media editor Warren...

Saskatchewan water agency invests in key infrastructure projects

REGINA – Saskatchewan’s Water Security Agency (WSA) is working on more than 60 w...

Government , Infrastructure

Industry Perspectives Op-Ed: Trudeau government doubles down on missing the mark

Earlier this year, public opinion research company Leger published the results o...

Associations , Government

Chandos names Sean Penn as new CEO

CALGARY – Chandos Construction has named Sean Penn as its new chief executive of...

Economic

CAPP shares mixed reaction to federal budget

CALGARY – The Canadian Association of Petroleum Producers (CAPP) is hopeful abou...

Associations , Government

Legal Notes: Too much information can be costly

Striking a balance between providing too little or too much documentation in sup...

Government

Liberals must now sell a budget they say will help younger Canadians catch up

OTTAWA — It's now up to the federal Liberal government to sell a spending plan i...

Economic , Government

TC Energy pipeline rupture sparks wildfire near Edson, Alta.

A natural gas pipeline owned by TC Energy Corp. ruptured near Edson, Alta., on T...

OH&S , Resource

National construction cost report forecasts slow 2024 growth

TORONTO — A new report forecasts cautious optimism for the Canadian construction...

Economic

Most Read News

B.C. ups investment in forestry sector with $70.3M in funding

VANCOUVER – The Province of British Columbia has announced a capital investment...

Government , Resource

Done: Expanded Trans Mountain pipeline launches May 1

Four-and-a-half years after construction began, one of Canada’s most controversi...

Infrastructure , Projects , Resource

Saskatchewan water agency invests in key infrastructure projects

REGINA – Saskatchewan’s Water Security Agency (WSA) is working on more than 60 w...

Government , Infrastructure

Winnipeg promotes infill development to reduce affordable housing shortage

In his recent State of the City address, Winnipeg Mayor Scott Gillingham says lo...

Economic

Federal budget introduces, elaborates on clean technology tax credit plans

The 2024 federal budget is re-emphasizing the government’s commitment to a globa...

Government , Resource

M5 at Main Alley: A 25-storey mass timber tower prototype

M5, a 25-storey, mass timber rental housing tower, one of the tallest in the wor...

Projects , Resource

New housing spending dominates Budget 2024

Federal Finance Minister Chrystia Freeland reiterated her government’s recent he...

Economic , Government , Projects

Preferred proponent announced for Surrey Langley Skytrain station construction

SURREY, B.C. – South Fraser Station Partners has been chosen by the Government o...

Government , Infrastructure , Projects

From ConstructConnect

Latest Infographics

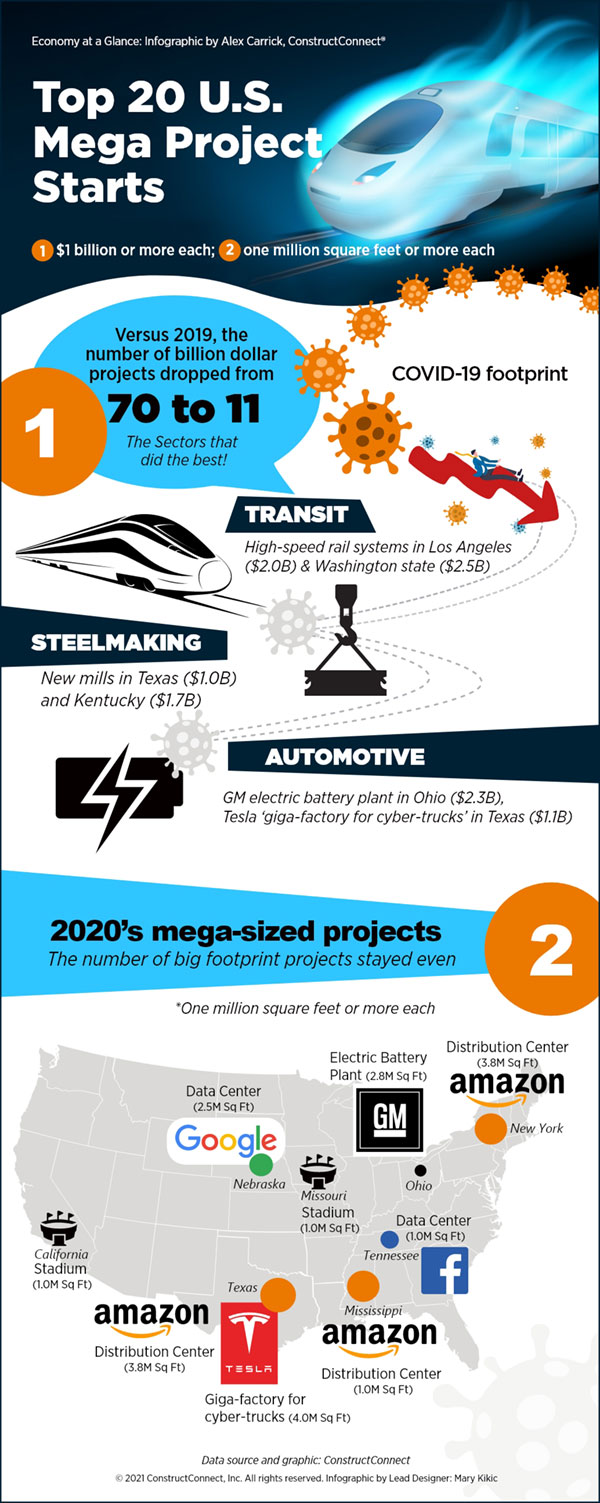

Top 20 U.S. Mega Project Starts

In 2020, there were 11 projects valued at $1 billion or more each, and 26 projec...

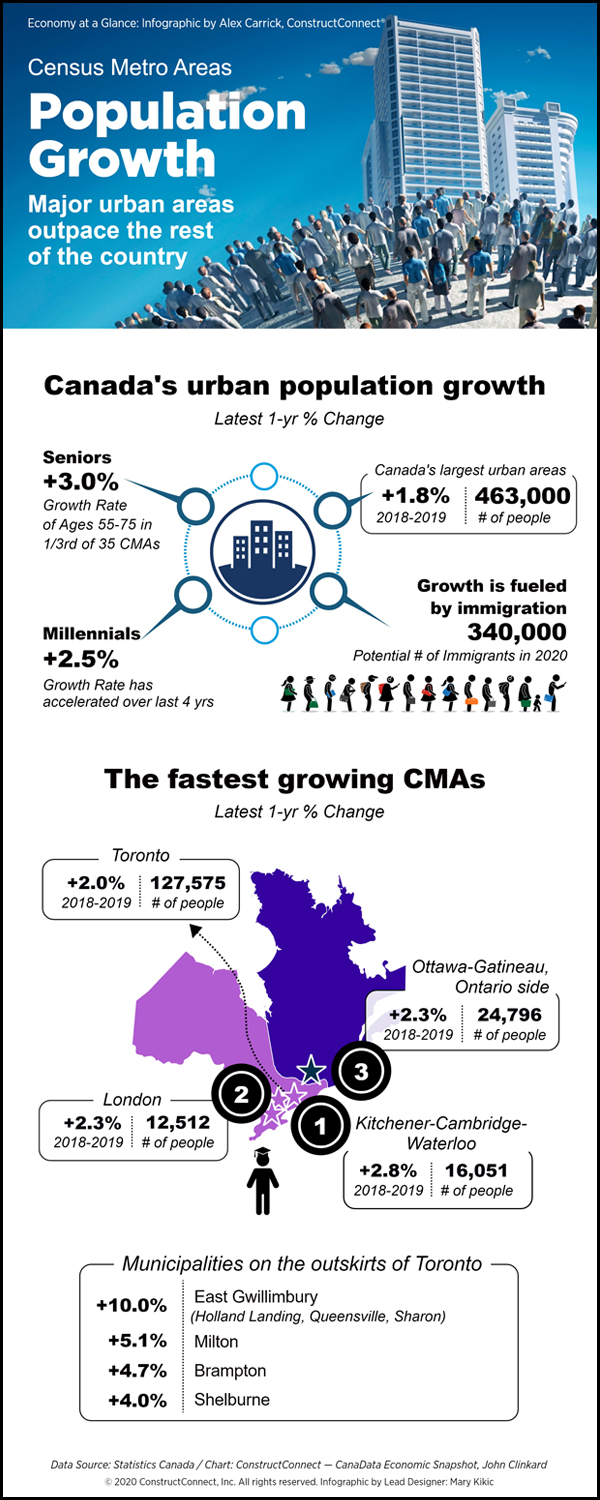

Canada's Urban Population Growth

This infographic looks at the surge in Canada's urban population growth.

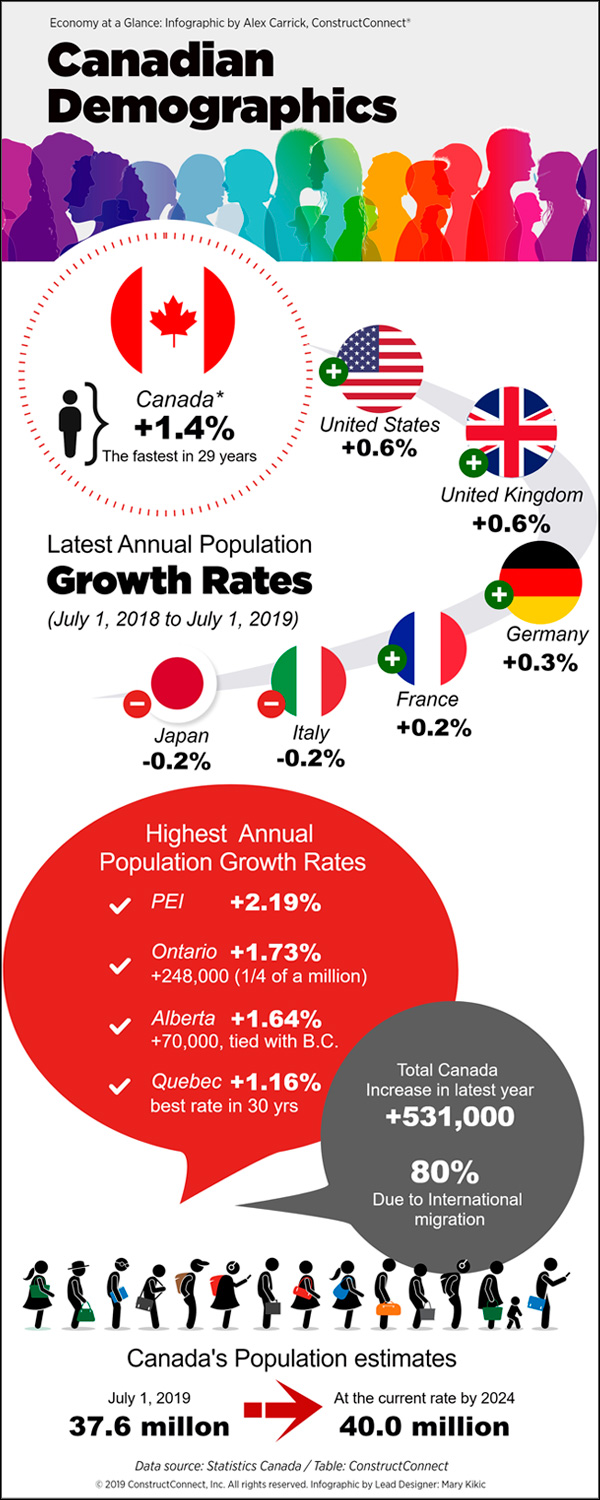

Canadian Demographics

This infographic looks at the latest Canadian population growth rates.